Overview

Latest News

This regulation is intended to promote an informed use of credit by consumers.

It also seeks to ensure that consumers are provided with more extenstive and timely information on the nature and costs of the residential real estate settlement process including more effective advance disclosure to home buyers and sellers of the settlement costs invovled.

It applies to each individual or business that offers or extends credit to consumers, with its credit offerings being a regular activity.

Latest News

More on CFPB

-

CFPB’s Vought requests Fed funding

In a court-ordered reversal, the beleaguered agency has agreed to seek quarterly funding from the Federal Reserve after all.

Alexander Barzacanos1 min read

-

Federal judge rules CFPB must continue to seek Fed funding

Trump administration lawyers argued that because the Federal Reserve was operating at a loss, the CFPB could not request funds from it.

Alexander Barzacanos1 min read

-

Fed OIG downgrades CFPB cybersecurity assessment to second-lowest level

Failure to maintain ATOs and lack of documentation key factors in decision.

Alexander Barzacanos2 min read

-

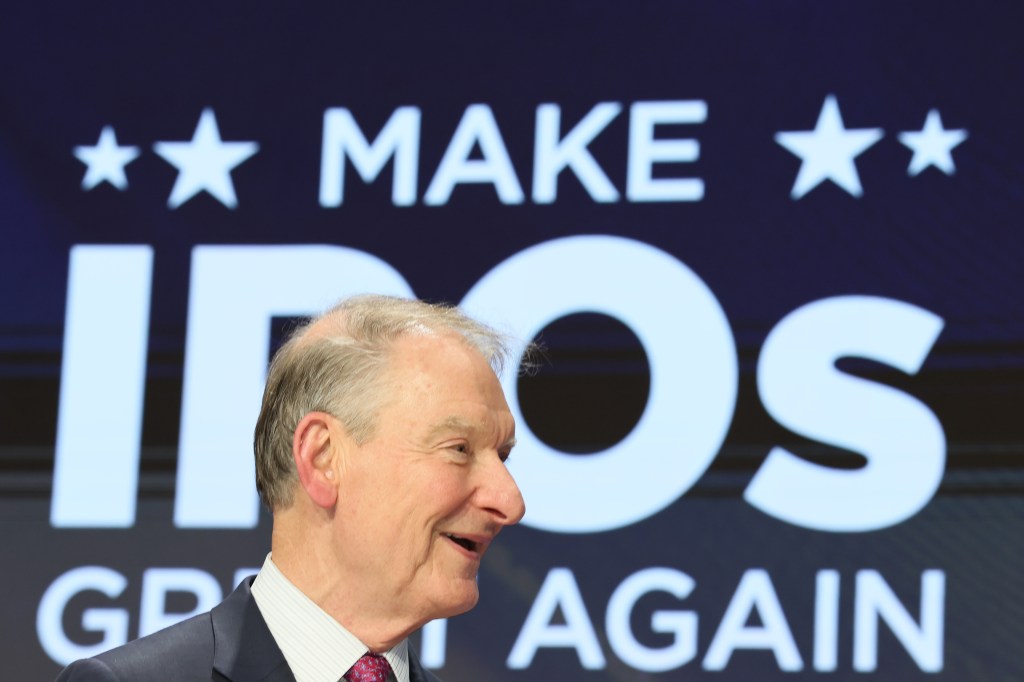

ABA President Rob Nichols outlines upcoming change for compliance regulation

Significant actions to rein in US banking regulation are underway, driven by the Trump administration with aims to spur lending and economic growth.

Julie DiMauro2 min read

-

GRIP Extra: Appeals court clears CFPB takedown, CFTC reviews internal time and attendance compliance

Our in-brief roundup of notable stories from the last week.

GRIP2 min read

-

New York AG sues Zelle parent for antifraud deficiencies

Alleging $1 billion in money lost to scams, New York takes up the mantle of a weakened Consumer Finance Protection Bureau.

Alexander Barzacanos2 min read

-

CFPB tables proposals for debt collectors, credit-reporting agencies, auto financers

All of these proposed rulemakings would alter the CFPB’s supervisory authority over nonbank entities operating in each of these markets.

Julie DiMauro4 min read

-

Trump issues executive order targeting debanking

The order, mandates a crackdown on "debanking" and ends the use of reputational risk in regulatory oversight.

Alexander Barzacanos1 min read